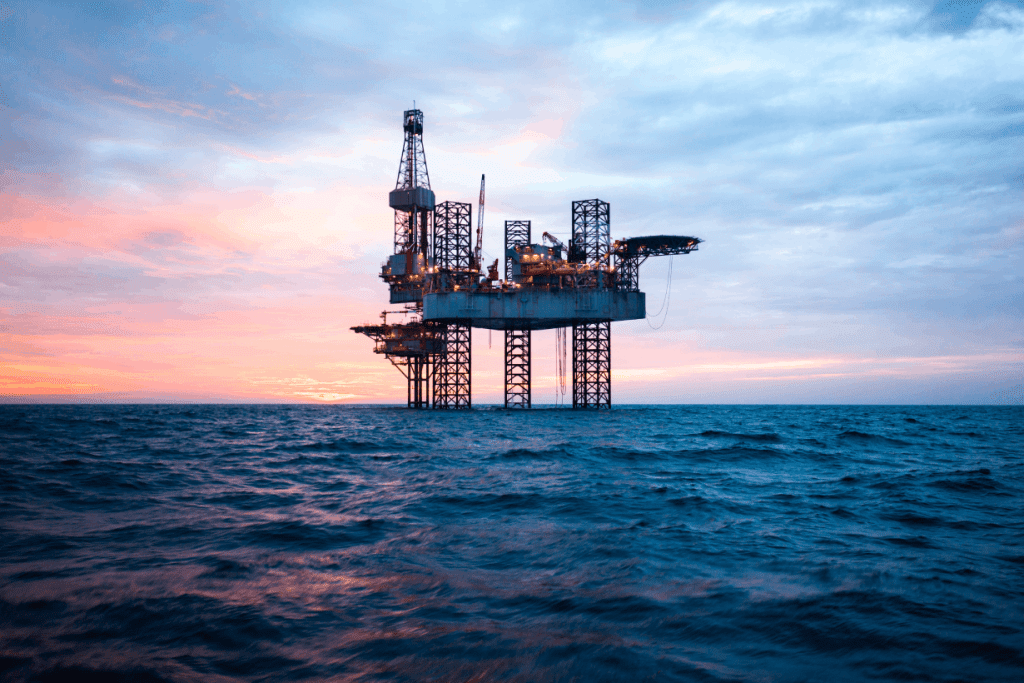

Creating at-scale supply chains and supporting oil and gas infrastructure will allow for crucial decarbonisation technologies for LNG in the future.

Natural gas imports and exports are typically carried out by pipelines and ships as liquefied natural gas. In addition, trucks import and export small amounts of natural gas, such as LNG and compressed natural gas (CNG).

Oil and gas transport and logistics at Aramex

A changing landscape

Due to a lack of technology, natural gas transport was only available through pipelines in the past. However, with the emergence of technology allowing natural gas liquefaction, LNG became an internationally traded commodity.

According to a report by McKinsey, the COVID-19 pandemic has accelerated LNG market trends that were already underway. It is noted that LNG’s long-term outlook is brighter than that of other fossil fuels due to its comparatively lower cost and lower emissions. However, to find a genuinely competitive advantage, LNG players must focus their efforts on five areas:

- Capital efficiency.

- Supply-chain optimisation.

- Downstream market development.

- Decarbonisation.

- Digital and advanced analytics.

LNG has lower cost and emissions than fossil fuels.

According to the report, despite its growing size and liquidity, the LNG market is far from an ideal “efficient” commodity market. Additionally, accelerating LNG demand growth requires LNG producers to invest significantly in new downstream infrastructure, including import terminals, pipelines, and power plants.

Related article: Can Crypto Mining Help Oil and Gas Sustainability?

“LNG producers have to make a significant investments in new downstream infrastructure, including import terminals, pipelines, and power plants, paving the way for oil and gas logistics companies.”

The future of liquefied natural gas: Opportunities for growth. ©McKinsey & Company

Real-world application

TotalEnergies, for example, has partnered with Adani in India to build a five-million-tonne-per-annum LNG import terminal and a distribution network that supplies six million households and 1,500 compressed-natural-gas fuel stations.

Not only LNG, but companies globally are also looking at logistics for more sustainable energy sources. For example, oil giant Chevron recently signed a joint study agreement to determine the feasibility of transporting liquefied carbon dioxide (CO2) from Singapore to permanent locations in Australia.

Under the terms of the joint study agreement, the firms will explore the technical and commercial feasibility of transporting up to 2.5 million tonnes of liquefied CO2 per annum by 2030.

Related article: 5 Busiest Shipping Routes of 2022 in the Growing Maritime Industry

This agreement is expected to complement the advancement countries are making in carbon capture, utilisation, and storage (CCUS) and will allow the exploration of more commercially driven solutions in CCUS, as well as alternate decarbonisation models.

However, CCUS uptake needs to grow 120 times by 2050 for countries to achieve their net-zero commitments.

Carbon capture, utilisation and storage needs to grow 120 times over by 2050 for countries to achieve their net-zero commitments.

The global freight and logistics market is projected to grow from $14.5 billion in 2021 to $18.6 billion by 2026, reflecting a CAGR of 4%. This growth is linked to increased global trade activities. Additionally, the retail oil and gas logistics market is expected to rise by $1.2 billion from 2022 to 2026, with a CAGR of 7%

Related article: Supply Chain Logistics Barriers and How to Overcome Them

The global freight and logistics market is expected to grow from $14.5B in 2021 to $18.6B in 2026 at a CAGR of 4%.

However, the oil and gas industry and its logistics are time-consuming and require expert local knowledge. For instance, Aramex first entered this market in 2010 with a project for NPS and has since seen considerable growth in its oil and gas logistics capabilities.

Oil and gas transport and logistics at Aramex

The global retail oil and gas logistics market is expected to grow by $1.2B during 2022-2026, accelerating at a CAGR of 7% during the forecast period.

Industry experts also claim that we must create at-scale supply chains and support infrastructure to allow for crucial decarbonisation technologies in the future.

Key takeaway

Companies and stakeholders need to safeguard and strengthen each step of the supply chain network to ensure the transition to more sustainable energy sources in the future.